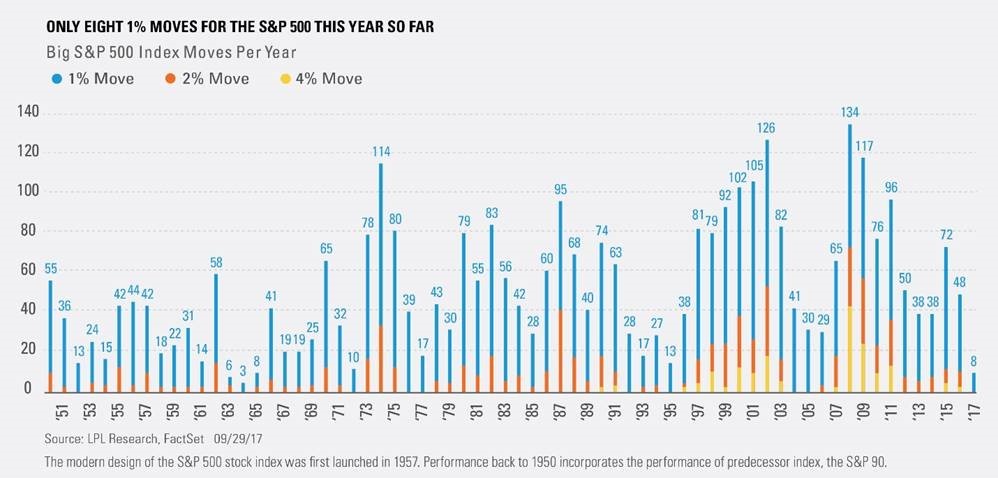

In the two year period from January 2016 to January 2018 the S&P 500 Index had only one month in which it dropped as much as 1%. That is a remarkable and unprecedented record of stability. During that time span the market rarely moved either up or down more than 1% per day, and for the chart-watchers, never once dropped below its 200 day moving average price.

All of that changed in February when the markets suddenly became wildly volatile. The Dow Jones Industrials dropped more than 1,000 points on two separate days and rose more than 300 points on five other days. After rising each and every month in 2017, the US markets dropped in February and March and ended the quarter solidly in the red for the first part of the year. The TSX was even more dismal, falling in each month of the first quarter. What’s going on here? As usual, it’s not just one thing, but a combination of factors.

The most obvious is that stock valuations have become pretty high, particularly in the US, after a terrific year in 2017 and after eight solid years of stock market growth since the end of the last recession. It is natural for investors to take some profits and reduce the risk in their portfolios. This is one reason why the part of the market that had the most outstanding returns, the technology-focused NASDAQ index, had the hardest fall, losing about 12% between its high in January and its low in March. This downward momentum has continued into the first week in April with the previous market leaders such as Facebook, Amazon and Netflix now down more than 15% from their highest levels.

Another obvious reason is the erratic, dangerous and unpredictable behavior of the President of the United States. By provoking a trade war with China, removing the remaining few respected economic advisors from the White House and taking pot-shots at companies such as Amazon, Donald Trump has shaken the confidence of investors. It is impossible to know what he might do next, and impossible, therefore, to forecast the consequences of his future actions and policies. A natural reaction to this is to take less risk, and the sell-off in markets is not only predictable, but also reasonable.

Finally, the actions of the Federal Reserve Bank of the US in raising interest rates and strongly indicating that it will continue to raise rates through at least the remainder of 2018 have increased the relative attractiveness of bonds and cash compared to stocks, and raised fears of a recession caused by over-tightening of the monetary system.

As Warren Buffett famously said, in the short term stock markets are voting machines, but in the long term, they are weighing machines. By this he meant that reason and analysis always take a backseat to rhetoric and headlines on a day-to-day basis, but that over time, the daily noise becomes insignificant. Towards the end of April, major corporations will begin reporting their earnings for the first quarter of the year. That is when the weighing starts and when the signal becomes louder than the noise. We expect to see strong gains in both revenues and earnings in the most recent quarter, and we believe that this is the information from which we can best calculate the value of the stocks we own.

The current volatile markets are unsettling, following as they do such a placid recent past. As painful as it may be to look at stocks falling from their recent highs, for long term investors such as us the sell-off provides a welcome opportunity to go shopping for bargains among stocks that have been on our “wish list” but which were previously too expensive for us to buy. We also are pleased to have a chance to beef up some smaller positions at lower prices.

For almost all goods and services, people buy less when the price goes up, and rejoice and buy more when the price goes down. Stocks seem to be unique in that people like to buy them more when they are more expensive. This is the kind of cognitive error that behavioural economists point at to show just how irrational investors are in their decision making. As long as economic conditions remain favourable and corporate earnings remain strong, we will continue to be buyers of the high quality companies that make up our client portfolios.

David Baskin

April 12, 2018